Hello, in this post we will look into the detailed guide to GSTR-3B. The topics which we will be discussing are meaning of GSTR 3B, Who should file GSTR 3B, Values to be shown in GSTR 3B, due dates, and Late fees and penalty.

What is GSTR 3B?

GSTR-3B is a self-declaration in which you have to report on the transactions monthly from July 2017 to June 2018.

If you have multiple GSTIN registrations, you have to file a GSTR 3B for each of the GSTINs.

In this form, you will be including the total value of the specified fields and not the value of each transaction.

Who should file GSTR-3B?

All the registered taxpayers have to file the return GSTR 3B including the nil returns.

What are the values to be shown in GSTR 3B?

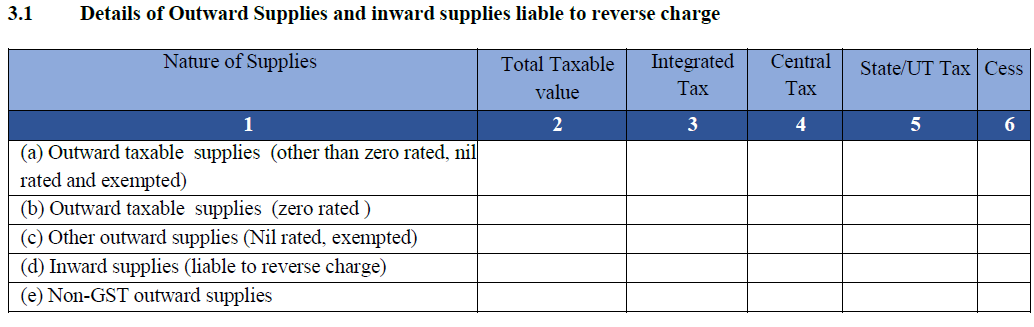

- Details of Outward Supplies and inward supplies liable to reverse charge

- Details of inter-state supplies made to unregistered persons, composition taxable persons and UIN holders for the above shown supplies.

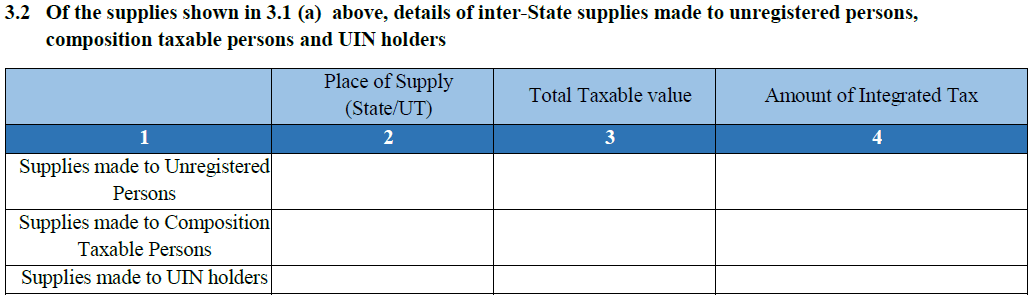

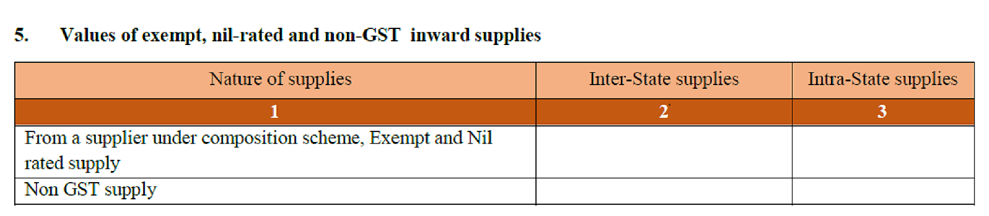

- Eligible ITC

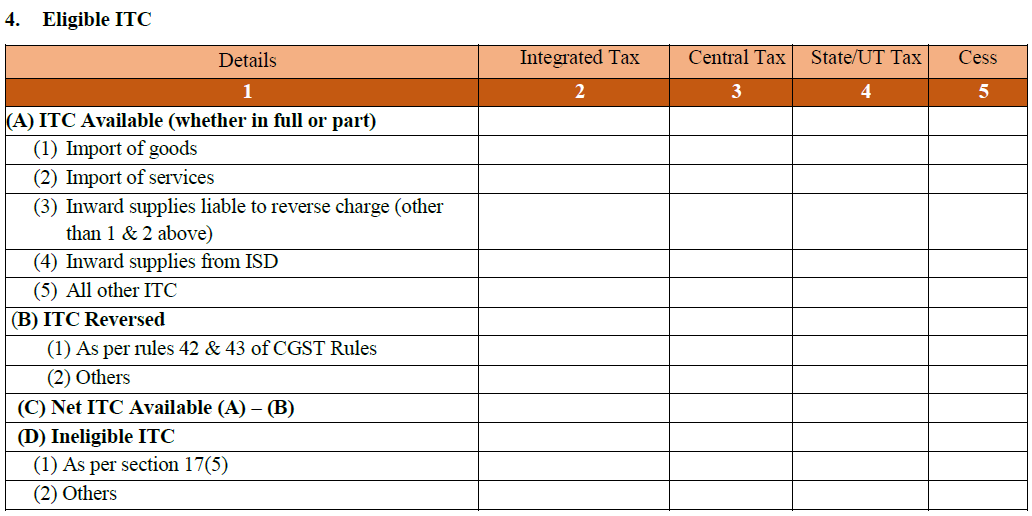

- Values of exempt, nil-rated and non-GST inward supplies

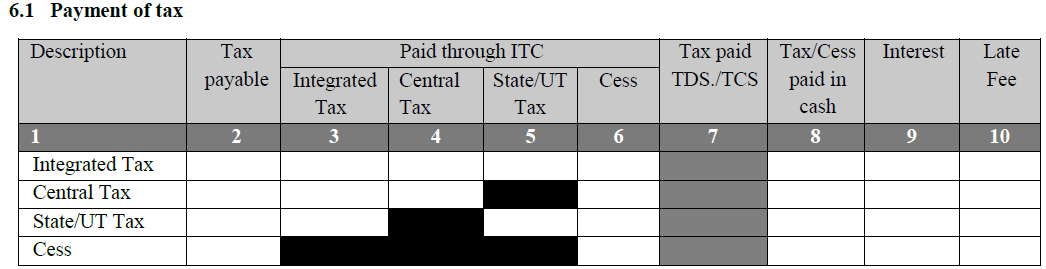

- Payment of tax

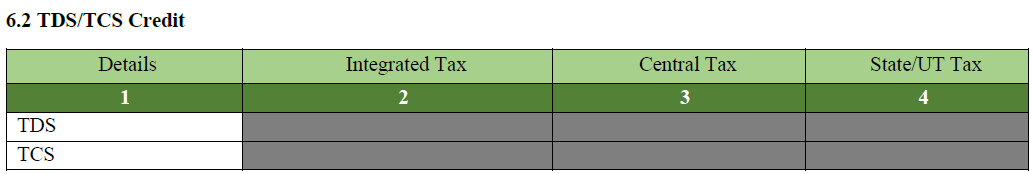

- TDS/TCS Credit

What is the due date for GSTR 3B filing?

The due dates for filing of GSTR 3B from August 2017 to June 2018 are:

Month |

Due date for GSTR-3B |

| August 2017 | 20th September 2017 |

| September 2017 | 20th October 2017 |

| October 2017 | 20th November 2017 |

| November 2017 | 20th December 2017 |

| December 2017 | 20th January 2018 |

| January 2018 | 20th February 2018 |

| February 2018 | 20th March 2018 |

| March 2018 | 20th April 2018 |

| April 2018 | 20th May 2018 |

| May 2018 | 20th June 2018 |

| June 2018 | 20th July 2018 |

Late Fees and Penalty

Late Fee for filing GSTR-3B after the due date is as follows:

- Rs. 50 per day of delay

- Rs. 20 per day of delay for taxpayers having Nil tax liability

Note – Late fee for the month of July, August, and September has been waived.

This ends our post on GSTR-3B. Let us know your opinion about this post by commenting below.