In today’s post, we will be looking into the step-by-step procedure for registration and e-filing of Form 15G and Form 15H in the Income Tax India e-filing portal. We have started from the registration under the e-filing portal to uploading of Form 15G/15H.

Step 1: Registration under the Income Tax India e-filing portal:

-

Open the Income Tax India e-filing website (You can click on this link and follow: http://www.incometaxindiaefiling.gov.in/ )

-

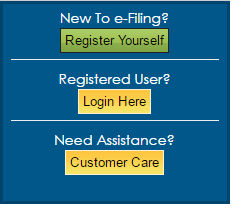

On the top right of the page you will find an option to register yourself or login. If you are a registered user, skip to Step 2 or else continue with the registration by clicking on the “Register Yourself” Button.

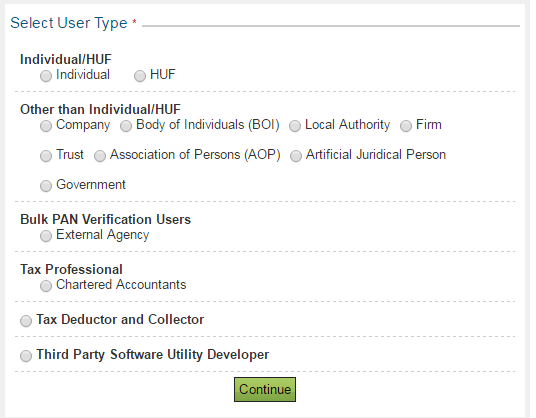

- If you click on the “Register yourself button” then you will be presented with the following screen. Here, select the option “Tax Deductor and Collector” and click on continue.

-

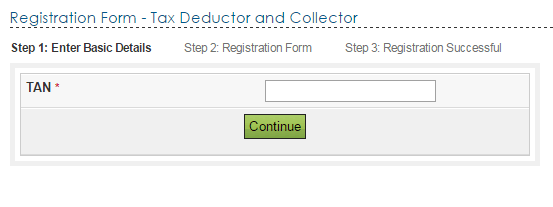

Now enter the TAN and click on continue

- Next you will be asked to enter all the required details in a registration form as shown below. User ID is taken as the TAN of the deductor. Other than that, continue to enter all the details and click on submit. This will show a “Registration successful” page.

-

Once the “registration successful” is shown, you need to log in through the individual PAN login in Income Tax website and approve the registration under “Work list”.

-

Once this is complete, you will get a mail to the registered email ID and a One Time Password(OTP) to the registered mobile number. You need to click on the link provided in the email ID and in the webpage enter the required details along with the OTP and submit.

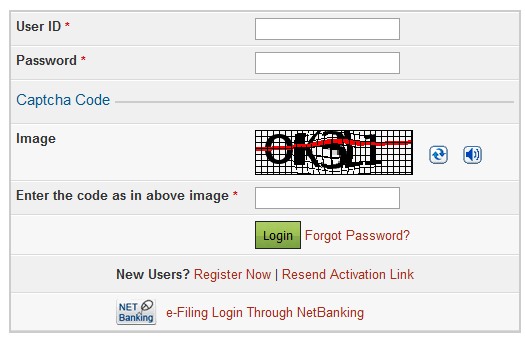

Step 2: The next step is to login using our user ID and password and then entering the captcha code. The user ID will be the TAN of the deductor.

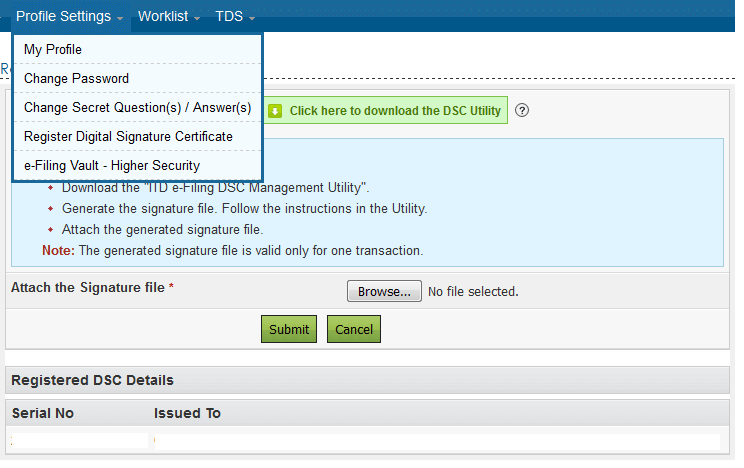

Step 3: Digital signature certificate registration: If you are newly registering, then you will need to register the Digital Signature Certificate of Responsible Person. For this, come to “Profile settings” in your dashboard and click on “Register Digital Signature Certificate” option. If it is already registered, it will be displayed in the “Registered DSC details”.

Step 4: In this step, we see how to do the e-filing.

-

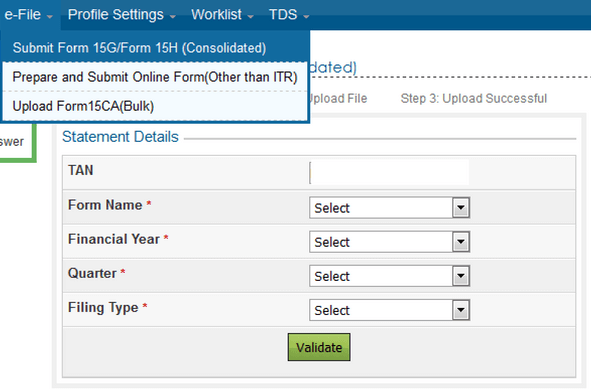

First click on e-File and select “Submit Form 15G/Form 15H” which will give the following screen. Here enter all the required fields and click on “validate”.

-

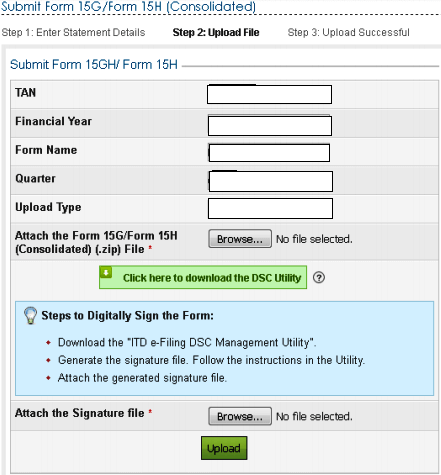

As soon as the validation is complete, the next screen will prompt you to upload the file. Here attach the consolidated (.zip) Form 15G/15H file

-

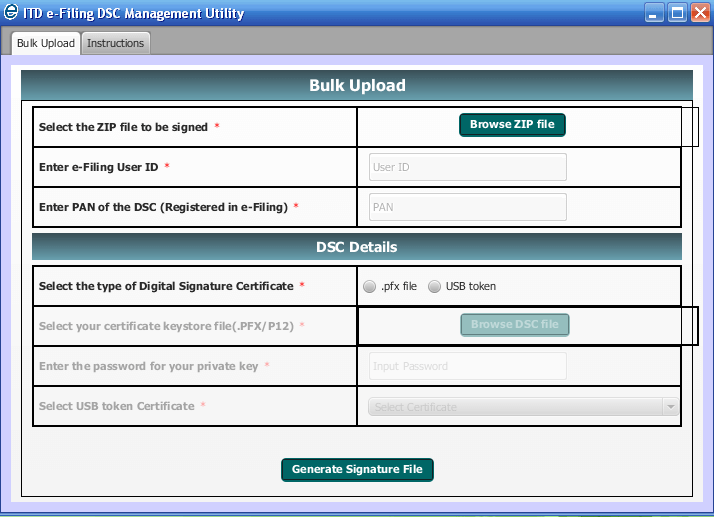

Now we need to validate the zip file using the DSC utility and generate certificate file.

-

The generated certificate file has to be uploaded at “Attach signature file”

-

Once the upload is completed, you will get an “Upload Successful” Screen along with the transaction ID.

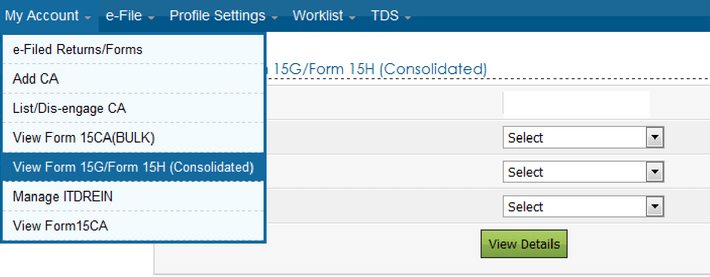

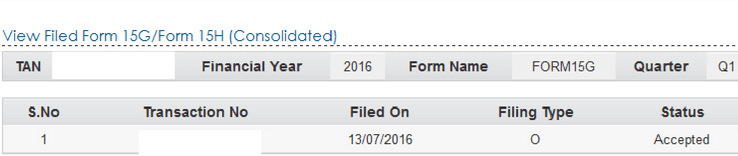

Step 5: The status of the uploaded file can be checked under “My Account” -> “View Form 15G/15H (consolidated)”. In this screen, you will be able to see the e-filing details and also if the uploaded file is accepted or not.

If you click on the transaction number, it will show the receipt number/acknowledgement number.

So there are the steps to the filing of form 15G/15H. We do hope that you found this helpful. Leave a comment below and let us know if this was helpful.

P.S: This article was written due to various requests from our blog readers and customers alike. So if you want to see anything like this again, let us know and we will try our best to get it across to you.

Related Topic : Procedure to allot UIN for Form 15G/ 15H